The new KYC Process and approch by Omri Raiter, the Chief Technology Officer of Hexatone Finance (Hextone Group)

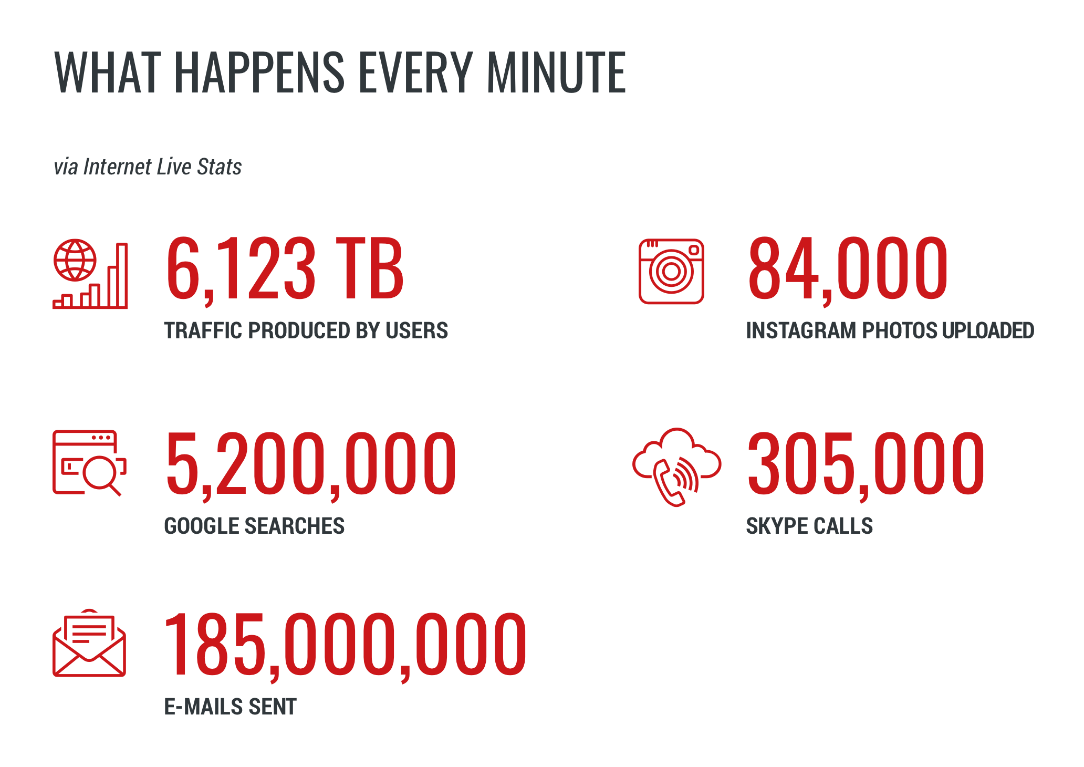

For most, the days of wandering into the local branch of your bank and getting assistance from a cashier are long gone. As countless sources have become available via the internet and social media, the global economy, including the financial services, has gone through a fundamental transformation, with the ability to improve operational processes, analyze and understand customers and mitigate risk through data.

Source: https://dzone.com/articles/big-data-trends-to-consider-in-2021

As we in Hexatone Group see with many financial firms we advise to, large amount of them are already deep into their Big Data journey, having invested heavily in technology and platforms to store, compute, and analyze information. For example, Bank of America was one of the first institutions to analyze publicly available social media data to understand how to improve customer service. This article discusses some of the top use cases for Big Data in financial services and the immense value it brings to the industry incumbents.

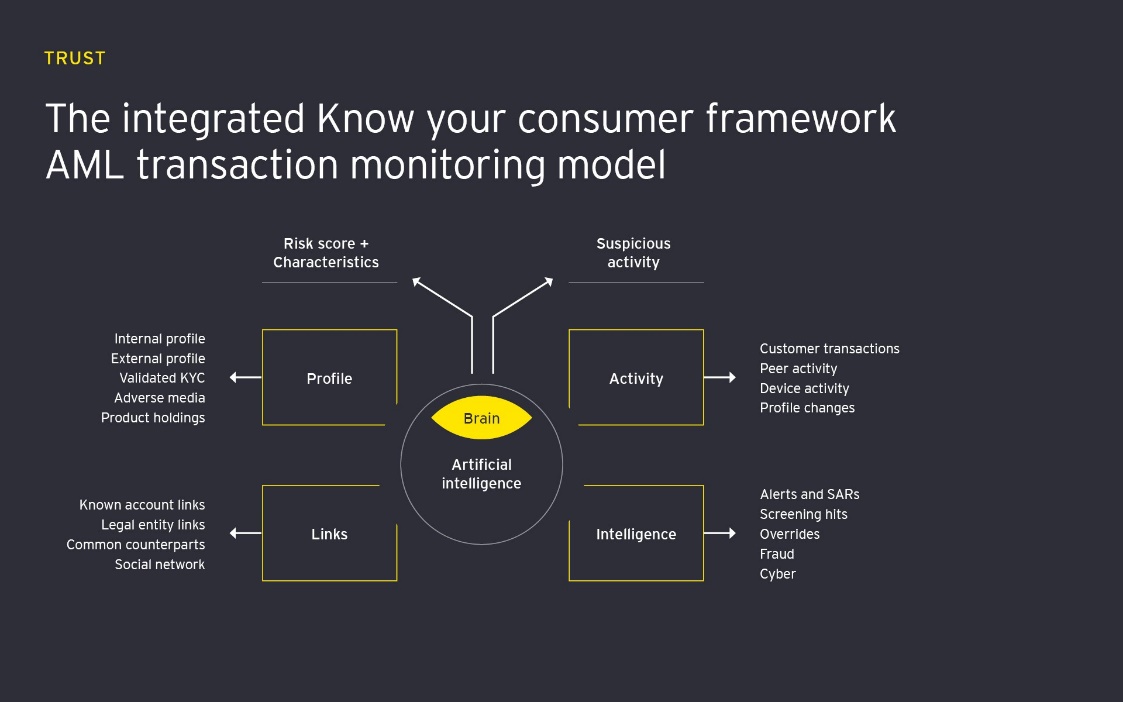

Accuracy and speed of AML processes

Anti-Money Laundering (AML) processes are typically laborious, slow, and prone to human error. Banks rely on manual processes for analyzing and monitoring transactions. Having enterprise scale platforms, that handle Big Data and makes AML far more accurate and efficient. Machine learning algorithms (a subset of artificial intelligence) can ingest and process vast amounts of data. Using the data, these algorithms can detect patterns in behavior that are signals of criminal activity and put the relevant customers forward for enhanced due diligence. The ability to process a massive amount of data means that machine learning will likely interrogate information that wouldn’t typically cross human eyes, adding accuracy and speed to decision making.

Source: https://www.ey.com/en_gl/trust/how-to-trust-the-machine–using-ai-to-combat-money-laundering

Better KYC processes

Know Your Customer (KYC) helps banks identify customers and any potential risks associated with them. It is an essential part of AML, and when done effectively, it should negate intentional or unintentional money laundering crimes. For example, a Datamatics case study shows how they worked with a leading bank to solve the typical data problems associated with KYC. The bank needed a way to speed up the processing of KYC forms and maintain their accuracy at times when human resources cannot cope with the volume.

Hexatone Financial division came up with a solution to enhance the entire KYC lifecycle by processing, managing, and retrieving data and generating reports in a short timeframe, usually between 60-120 seconds. The impact we see is upto 50% reduction in person-hours and a 60% increase in productivity.

Cybersecurity

Back in 2017, Equifax reported a data breach that revealed the personal details of about 50% of Americans (147 million people). Since then, cyber security has become one of the priorities for Big Data. Machine learning models can analyze patterns and abnormalities in data networks that may indicate potential cyber threats. As banks continue to move more services to digital environments, this type of software becomes pivotal to improving customer security.

Source: https://www.ocorian.com/article/beware-evolving-beast-cybersecurity-financial-services

Customer Insights and Profiling

According to a CapGemini report, banks that apply analytics to customer data have a 4% point lead in market share over banks that do not. Big data solutions help banks to generate leads for customer acquisition more effectively by integrating with CRM systems and call centers. At US Bank, datav analytics enabled a single customer view across online and offline channels, improving lead conversion rate by over 100%.

At Deutsche Bank, numerous Big Data platforms and technologies are used to mine information and process it into an understandable format for experts to draw insight. Matching algorithms tell them what a dataset is saying about their sales, satisfaction rates, and investment returns. The result is a truer meaning and deeper perspective in their numbers. The use of automated personalized recommendation engines also helps the bank to improve customer engagement and deliver tailored product messages.

Customer analytics also helps financial firms segment their audience into categories based on socioeconomic status, geolocation, age or employment status. Banks and other services can develop products suited to each segment. The vast amounts of data can help predict what a customer is likely to want next, simplifying firms’ decision-making process.

Minimizing operational costs

According to Accenture, AI and data can help banks reduce costs by up to 25%. AI tools can gather data, classify it, and action it without the need for human intervention. For example, they could track an email inbox for a specific type of invoice. Once found, it will search for relevant text in the data and input it into a back-office system before reviewing it and reaching a conclusion. Humans can focus on more creative and complex tasks, leaving the rest to AI and Big Data processes.

From a customer perspective, online applications algorithms can use third-party data to pre-fill forms and assess liability. Customers don’t need to find and enter data that is readily available elsewhere manually.

Summary

The financial services industry has made considerable strides in adopting Big Data processes over the last decade, and the Covid-19 pandemic has further accelerated that. Banks and other firms have innovative solutions in place to enhance operations, understand customers, negate risk and reduce cost. As we at Hexatone Group see everyday, the world continues to shift to digital channels, and data will only become more pivotal to the future of financial institutions.

Omri Raiter,

Cofounder and Chief Technology Officer,

Hexatone Group.

![[CEO Spotlight] Interview with Artist and Record Label Owner Young Mo Da Great](https://forbesglobalnews.com/wp-content/uploads/2022/02/Young-Mo-pic-1-218x150.jpg)